In today’s fast-paced business environment, maintaining a healthy cash flow is crucial for the success of any enterprise. Factoring is a financial tool that can provide immediate liquidity to businesses by converting unpaid invoices into cash. But when should businesses consider applying for factoring, and how can it benefit their operations?

What is Factoring?

Factoring, also known as invoice factoring, involves businesses selling their accounts receivable (invoices) to a third-party factoring company at a discount. This provides businesses with immediate cash, eliminating the wait for payment terms that typically span from 30 to 90 days or more.

The factoring company assumes the responsibility of collecting the payments directly from the customers. This process helps improve cash flow and allows businesses to focus on growth and operations without the delay of outstanding invoices.

Factoring is different from a loan because it involves the sale of an asset (the invoice), and it doesn’t create debt on the company’s balance sheet. It’s particularly useful for businesses that need quick access to capital to manage day-to-day operations, invest in growth opportunities, or bridge gaps between payables and receivables.

Signs Your Business Might Benefit from Factoring

Recognizing when to apply for factoring can be crucial for maintaining your business’s financial health. Here are some common indicators:

Consistent Cash Flow Issues

If your business frequently struggles with cash flow due to delayed payments from customers, factoring can provide the immediate funds needed to cover operational costs and payroll.

Rapid Business Growth

While rapid growth is a positive sign, it often leads to increased operational costs and the need for more working capital. If your business is expanding quickly and you need funds to support this growth, factoring can supply the necessary liquidity without incurring additional debt.

Long Payment Terms from Customers

Businesses that work with clients who have extended payment terms (60-90 days) may find it challenging to manage cash flow. Factoring can bridge this gap by providing immediate cash against outstanding invoices.

High Accounts Receivable

If a significant portion of your working capital is tied up in unpaid invoices, factoring can help unlock these funds. This allows you to reinvest in your business or cover urgent expenses.

Benefits of Factoring for Businesses

Factoring offers several advantages that can enhance your business’s financial stability and operations:

Improved Cash Flow

One of the primary benefits of factoring is the immediate improvement in cash flow. This allows businesses to meet their financial obligations promptly and avoid late fees or penalties.

Access to Immediate Funds

Unlike traditional loans, which can take weeks or months to secure, factoring provides quick access to funds. This speed can be critical for businesses facing unexpected expenses or opportunities that require immediate action.

Reduced Credit Risk

When you factor in your invoices, the factoring company assumes the credit risk associated with your customers. This reduces the risk of bad debts and provides a more predictable cash flow.

No Debt Accumulation

Because factoring is not a loan, it doesn’t add to your business’s debt burden. This can be particularly beneficial for businesses that want to improve their balance sheets and maintain a healthy financial profile.

How to Apply for Factoring

Applying for factoring is a straightforward process, but it requires some preparation. Here’s a step-by-step guide:

Step 1: Research Factoring Companies

Start by researching reputable factoring companies that specialize in your industry. Look for companies with positive reviews, transparent terms, and competitive rates.

Step 2: Prepare Necessary Documentation

Factoring companies typically require specific documents to assess your business’s eligibility. These may include:

- Recent financial statements

- Aged accounts receivable report

- Copies of invoices to be factored

- Customer credit information

- Business registration documents

Step 3: Submit an Application

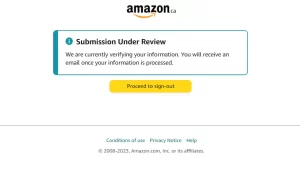

Complete the factoring company’s application form and submit the required documents. The company will review your application and perform due diligence on your customer’s creditworthiness.

Step 4: Review the Offer

Once your application is approved, the factoring company will present you with an offer detailing the advance rate, fees, and terms. Review the offer carefully to ensure it meets your needs.

Step 5: Sign the Agreement

If you’re satisfied with the offer, sign the factoring agreement. This contract will outline the terms and conditions of the factoring arrangement.

Step 6: Receive Funds

Upon signing the agreement, the factoring company will advance the agreed-upon percentage of the invoice value (typically 70-90%). You’ll receive these funds within a few days.

Conclusion

Factoring can be a powerful financial tool for businesses facing cash flow challenges, rapid growth, or lengthy customer payment terms. Providing immediate liquidity, reducing credit risk, and avoiding additional debt, factoring helps businesses maintain financial stability and seize growth opportunities.

If your business is experiencing any of the signs mentioned above, consider exploring factoring as a solution. Start by researching reputable factoring companies and preparing the necessary documentation to secure the funding you need to drive your business forward.