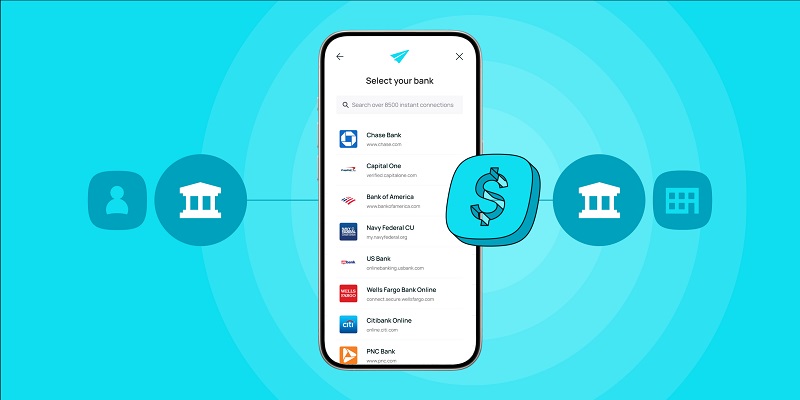

Convenience and effectiveness are essential for preserving client happiness in today’s fast-paced environment, particularly for companies that provide subscription or recurring services. The best way to streamline transactions is with ACH (Automated Clearing House) payments. Businesses may provide a smooth payment experience that encourages client loyalty and trust by utilizing ach merchant accounts.

Simplifying Recurring Transactions for Customers

Because of their well-known ease of use, ACH payments are especially beneficial for regular purchases. The automatic system guarantees that money is transferred straight from customers’ bank accounts on prearranged dates, eliminating the need for human payments and missed deadlines. Customers can feel less stressed about regular billing thanks to this hassle-free method. Additionally, companies can reduce issues pertaining to payments, fostering a more harmonious connection with their customers.

Cost-Effective Payment Processing

The affordability of ACH payments in comparison to other payment options like credit cards is one of their biggest benefits. Lower processing fees are sometimes associated with ACH transactions, which can save money for both clients and companies. Reduced costs frequently result in better deals or extra perks for clients, raising their sense of value. Because of their price, ACH payments are a desirable choice for subscription services, where regular, inexpensive transactions are necessary to maintain long-term client happiness.

Enhancing Payment Reliability and Security

Customer happiness is largely dependent on reliability, and ACH payments are excellent at it. ACH transactions rely on reliable bank account information, in contrast to credit card payments, which are susceptible to expiration dates or possible fraud-related interruptions. Customers are less irritated because of this uniformity, which guarantees that payments are completed without needless delays. Additionally, ACH networks use strong security protocols, giving users the assurance that their financial information is safe while transactions are being conducted.

Supporting Environmentally Friendly Practices

ACH payments support eco-friendly business operations, which are becoming more and more significant to today’s consumers. ACH transactions cut down on paper waste and the carbon footprint of conventional payment systems by doing away with the need for paper checks, envelopes, and postage. Consumers that respect sustainability favor companies that put an emphasis on environmentally sustainable solutions. In addition to improving customer pleasure, this alignment with customer values upholds the company’s standing as a socially conscious enterprise. By making ACH payments available, businesses may satisfy the increasing need for environmentally friendly practices while also streamlining regular transactions, benefiting both clients and the environment.

Conclusion

For companies handling recurrent transactions, ACH payments are revolutionary. They give consumers a smooth and safe experience while streamlining the payment process, cutting expenses, and improving dependability. Businesses may increase customer happiness, cultivate loyalty, and keep a competitive advantage in a market that is becoming more and more demanding by implementing ACH merchant accounts. Adopting this payment option is a calculated move that will strengthen ties with clients in addition to being convenient.